One important thing to remember is that although the major credit bureaus often get grouped together, they're competitors and they might not have the same information about you. court system, such as whether you've declared bankruptcy, and add this to your credit reports. Additionally, the major credit bureaus may collect some types of public records from the U.S. Most of the information on your credit report comes from companies (called data furnishers, or just furnishers for short) reporting your account information to the CRAs.

#Great credit score range update

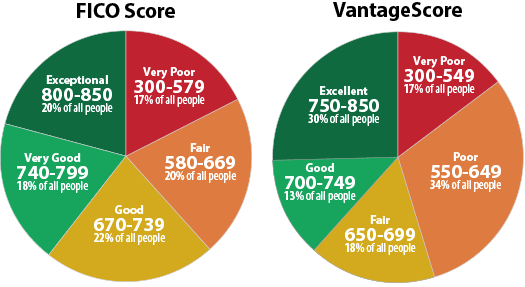

It can then update the CRA each month to report your card's balance, your payment amount, and whether you paid on time or were late. It can also report your account information, such as when you opened the credit card and your credit limit. The credit card company may report your name, address, date of birth, Social Security number (if you have one), and phone number from your application to the CRAs. If this is the first time you've had an account reported to the CRAs, it will be the only account (known as a "tradeline") in your credit report. These CRAs are sent information from creditors and collects information on millions of residents and uses this information to create credit reports.įor example, if you apply for a credit card and get approved, the credit card issuer may send information about your account to one, two, or all of the three major CRAs. In the U.S., there are three primary nationwide consumer reporting agencies (CRAs) that create consumer credit reports: Equifax, Experian, and TransUnion. Many credit scores are based entirely on the information in one of your credit reports. Additionally, you could have to pay a security deposit before you can turn on utilities, internet, or television service for your home. It can also be hard to get approved for a rental home, or you may have to pay a larger down payment even if you are approved. You might have trouble getting certain types of jobs if you have a bad credit history. Additionally, your credit may be a factor when you're applying for a job, want to rent a home, are setting up a new account with a utility or cell phone provider. In most states, your credit history can impact your insurance rates and having poor credit can lead to paying higher auto and homeowners insurance premiums. Whether you're trying to take out a small personal loan, a private student loan, a student card, or borrow money to purchase a home, having good credit can help you qualify for a lower interest rate, fewer fees, higher loan amount and more favorable repayment terms.Įven if you never take out a loan or open a credit card, your credit can be important to your financial and personal life. The difference between having a poor credit score and good credit score can be thousands (sometimes hundreds of thousands) of dollars over your lifetime.Ī higher score can help you get the better rates and offers on the best credit cards, a better line of credit, and loans. To better understand why there are different score ranges, let's take a quick look at how credit scoring works in the United States and why credit is important. Over time, this could help increase your scores. Once you know how credit scores work, you can take steps to build your credit history and responsibly manage your accounts. Getting a good credit score can take time, especially if you've recently moved to the U.S. Good credit scores typically fall between 660 to 670 in the United States while an excellent credit score typically starts at 750.

0 kommentar(er)

0 kommentar(er)